Your New Secret Weapon is Here!

Customer Lifetime Value (CLV) is a term from business administration and indicates how much a customer is worth during her overall interaction with a company.

In this article, we will explain the CLV definition in more detail, introduce the CLV formula, and describe actions companies can take to increase the customer lifetime value of their customers.

What is Customer Lifetime Value?

Customer lifetime value is defined as the individual customer value for each customer relationship within a company. This customer lifetime value has two key indicators - historical and potential customer values.

The goal is to monitor the marketing process in line with Customer Lifetime Value so that customer relationships will be of the highest customer value.

This understanding provides valuable information about customers to help with marketing campaigns and acquisitions. This focus should therefore be on developing long-term qualitative relationships.

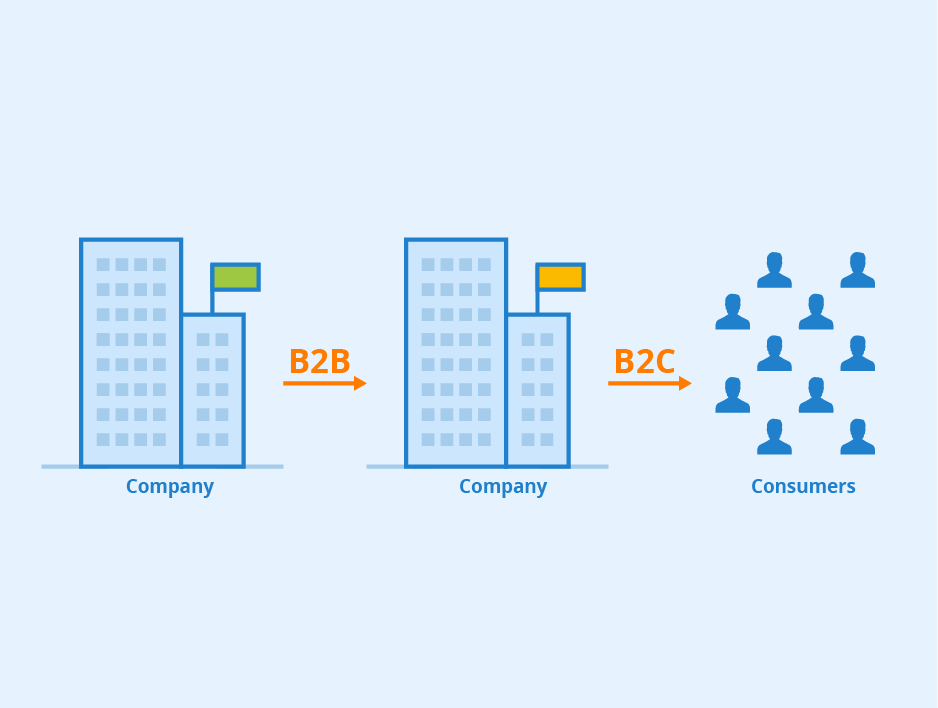

CLV in the B2C vs. CLV in the B2B area

Customer lifetime value (CLV) indicates how much a customer is worth while working with the company in both the B2C (business-to-consumer) and B2B (business-to-business) sectors. However, there are some important differences between Customer Lifetime Value in B2C and CLV in B2B.

One important difference is the duration of the customer relationship. As a rule, the customer relationship in the B2B area is longer than in the B2C area. This is because companies in the B2B sector usually have larger and more complex projects and therefore need longer-term partnerships to complete them successfully. This means that the CLV in the B2B area is usually higher than in the B2C area.

Another difference is that customer lifetime value in B2B often depends on the size and revenue of the customer company. The larger and more successful a customer company is, the higher the customer lifetime value usually is. The clientele or target group therefore makes a lot of difference when it comes to calculating the Customer Lifetime Value.

Classification, background and significance of the CLV

More and more companies are recognizing the important role that Customer Lifetime Value plays in shaping customer relationships and strategies. In this article, we will take a closer look at the classification, background and significance of Customer Lifetime Value, especially in connection with CRMs (Customer Relationship Management), customer care and the customer lifecycle.

We will also discuss the various ways in which companies can determine and increase the Der Customer Lifetime Value of their customer relationship.

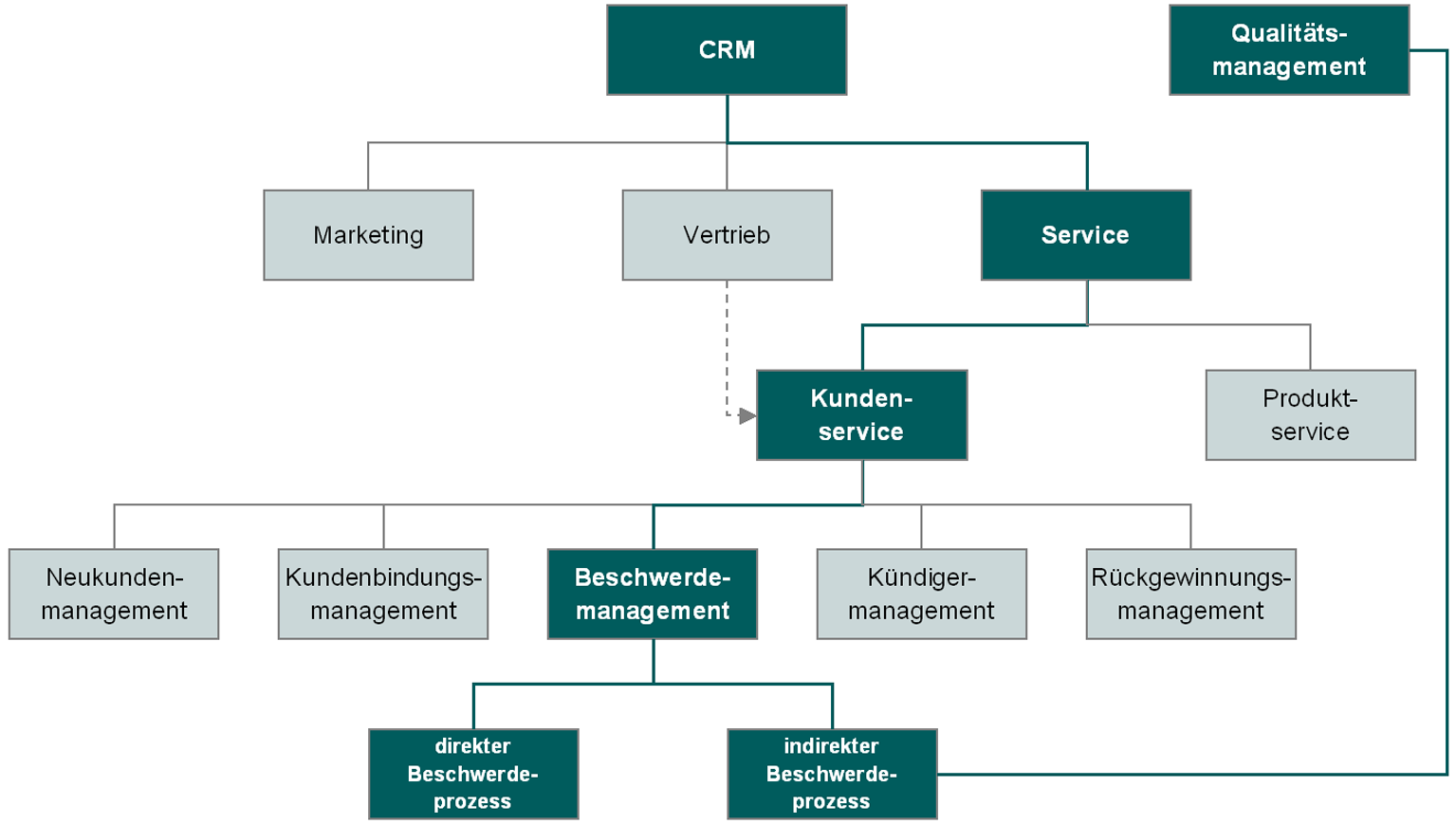

Customer Lifetime Value and CRM

Customer Relationship Management (CRM) is an approach that aims to improve customer management by storing all interactions and information about them in a central database.

CLV and CRM are closely related, as both aim to improve a company's customer relationships and strategies. If companies want to determine and increase their customer lifetime value, they can use CRM systems to collect and analyze relevant information about their customers. This information can then be used to develop personalized marketing activities and make marketing spend more effective.

The CRM system can also help simplify CLV calculations by automatically collecting and providing key data such as average revenue per customer, customer loyalty rate, and average customer acquisition cost.

In addition, the CRM system can also help to optimize the sale of products and services to existing customers.

Customer care and customer acquisition

Three out of four companies in the United States use customer lifetime value in customer services and product development. This gives companies a better understanding of how to improve the relationship. The CLV concept believes a holistic approach to marketing is critical and includes the integration of social media data with social media.

CLV and marketing mix

Marketing is characterized by four pillars: Product policy, pricing policy, communication policy and distribution policy. Each of them is interrelated and ensures coordinated communication and sales activities. In this sense, customers respond differently to different marketing tactics during their interactions with a company or business. Thus, the key figure may differ depending on the mix.

How can customer lifetime value be calculated?

To calculate the CLV of a customer, companies can use various methods, such as the so-called "single period value" method or the "multiple period value" method.

Calculation: Single Period Value Method (SPV)

The single period value method (also referred to as the "one-period method") calculates a customer's CLV based on its expected revenues and costs during a specific period (e.g., one year). The formula is as follows:

CLV = (Average revenue per customer x customer loyalty rate) - Average customer acquisition cost

Calculation example 1 (SPV formula)

Calculation example: Assume a company has average revenues of EUR 1,000 per customer, a customer loyalty rate of 90% (i.e. 90% of customers remain loyal to the company) and average customer acquisition costs of EUR 100 per customer. The CLV of a customer in this case would be (1,000 EUR x 90%) - 100 EUR = 900 EUR.

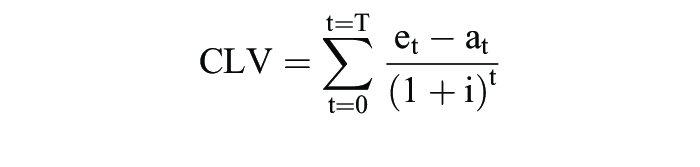

Calculation: Multi Period Method (MP)

The multiple period value method (also referred to as the "multi-period method") calculates a customer's CLV based on its expected revenues and costs during multiple time periods (e.g., multiple years). The formula is as follows:

CLV = [(Average revenue per customer x customer loyalty rate) - Average customer acquisition cost] / Discount rate

The discount rate is a percentage that takes into account the time value of money. It indicates how much money will be worth less in the future than it is today. The discount rate is usually calculated on the basis of the current market interest rate.

Calculation example 2 (MP formula)

Calculation example: Assume a company has average revenues of EUR 1,000 per customer, a customer loyalty rate of 90% (that is, 90% of customers remain loyal to the company), average customer acquisition costs of EUR 100 per customer, and a discount rate of 10%. The customer lifetime value of the customer in this example would be [(1,000 EUR x 90%) - 100 EUR] / 10% = 890 EUR.

Why is customer value important to your business?

The calculation of the CLV ratio or customer lifetime value is particularly important. A high customer value is an indicator that a company is successful and that it is able to meet the needs and expectations of its customers.

There are several reasons why calculating customer value is important:

- It helps companies drive growth: High customer value can help drive a company's growth by generating more revenue and increasing customer loyalty.

- It improves customer loyalty: customers with a high customer value tend to be more loyal and stay with the company longer. This can help reduce the risk of customer loss.

- It increases customer satisfaction: Companies that successfully increase their customer value also tend to have happier and more satisfied customers. This can help strengthen the company's positive image.

- The metric can help companies assess the profitability of marketing campaigns and other customer acquisition strategies. It also helps with customer service. If a customer's CLV is high, it means that the company will benefit from its cooperation with that customer in the long run. On the other hand, if a customer's CLV is low, it might be less worthwhile for the company to invest time and resources in acquiring that customer.

- Overall, CLV is an important factor that companies should consider when planning and managing their customer relationship and strategies. By understanding and increasing CLV, companies can drive growth, increase customer loyalty, improve customer satisfaction, and make informed decisions.

- The calculation of this key figure is also particularly important for customer service.

Possible measures to increase the customer lifetime value

Can a company calculate customer values when their value is low? Why are they so cheap to buy? Of course: try to increase your CLV. Unfortunately, this is easier said than done, as the value varies depending on various factors.

Before you do anything, it's important to identify the root causes. In particular, the way a company tries to attract more clientele may not be effective enough. Then it's too expensive to make a profit. Another problem is customer service.

Convert leads/visitors to customers better

Sales can generate much higher revenue in conjunction with online marketing when they work together. Marketing efforts for customer acquisition should be optimized for the clientele and sales should take advantage of marketing messaging.

It is advisable to use a tool to increase collaboration and sales. Our recommendation clearly lies with the inbound conversion platform meetergo. This not only places value on the acquisition of new customers, but also on data protection. This increases trust and, above all, profits.

Expand email marketing

Email is a very useful tool to stay in touch. Divide the audience by specific characteristics, interests and purchase history and send it regular content that meets their needs. Reach the optimal package for all segments when needed. For example, the athlete tends to wear sportswear and the parents prefer to see their children's clothes.

Marketing measures to increase CLV value

In order to increase sales and increase the value of the customer, the entire customer life, it is recommended to conduct A/B tests. These test how customer A reacts to adjustments on e.g. the website and compares these with customer B.

Thus. marketing can also take over parts of customer management.

Supplementing offers and upselling

Look at ways to add value by adding a specialized service. You can look forward to getting the same expertise when you buy your new stove. Alternatively, you can buy matching bulbs for the lamps. You can either make a matching follow-up offer when you buy, or extend a range of products that complement an entire line.

Offer special promotions

Special offers that can be applied only a little time, coupons or loyalty programs help to attract new customers. But here you need to make sure that you make good profits.

FAQ

What is a good customer lifetime value?

It is difficult to give specific amounts for a "good" CLV, as it depends on various factors and can vary from industry to industry. A high CLV may be considered very good for a company in one industry, while it may not be so high in another.

For example, suppose a company sells software solutions to large corporations and has an average Customer Lifetime Value of 50,000 euros per customer. If the company acquires 1,000 new customers every year and loses 500 customers every year, it would have a CLV of 25,000 euros per customer. In this case, a CLV of 50,000 euros per customer would be considered very good, as it is significantly higher than the average Customer Lifetime Value of the company.

How do I calculate the CAC?

Customer Acquisition Cost (CAC) is the total amount a company spends to acquire new customers. To calculate the CAC, you can use the following formula:

CAC = Total customer acquisition costs / Number of new customers

Customer acquisition costs include all costs incurred in connection with the acquisition of new customers, such as marketing campaigns, sales commissions and bonuses, distribution costs, etc.

Example: Assume that a company has spent a total of 100,000 euros on customer acquisition in one year and has acquired 1,000 new customers in the same period. The company's CAC in this case would be 100,000 euros / 1,000 = 100 euros per customer.

It is important to note that CAC depends not only on current customer acquisition costs, but also on the expected lifetime of a customer and the associated future revenues. Companies should therefore also include the future revenues of their customers in their CAC calculations.

What is the customer lifecycle?

The customer life cycle (also referred to as the Customer Life Cycle) describes the various phases that a customer goes through during his or her cooperation with a company. The exact phases of the customer life cycle can vary from company to company, but in general the customer life cycle includes the following phases:

- Attention: In this phase the customer becomes aware of the company or its products and is interested in further information.

- Interest: In this phase, the customer shows an active interest in the company's products or services and may be looking for more information or opportunities to try the product.

- Consideration: In this phase, the customer considers whether the product or service is suitable for them and may compare different options.

- Purchase: In this phase, the customer decides to buy the product or service.

- Use: In this phase, the customer uses the product or service and may have feedback or suggestions for improvement.

- Loyalty: In this phase, the customer remains loyal to the company and possibly buys further products or services.

- Churn: In this phase, the customer loses interest in the company's products or services and may look for alternatives.

Companies can understand and track the customer lifecycle to better understand their customers' needs and expectations and improve their relationships with them. They can also develop various marketing and sales strategies to support and serve customers at each stage of the lifecycle.

How do you calculate customer lifetime value?

Customer Lifetime Value (CLV) indicates how much a customer is worth during their overall relationship with a company. To calculate the CLV of a customer, companies can use the following formula:

CLV = (Average revenue per customer x customer loyalty rate) - Average customer acquisition cost

Your New Secret Weapon is Here!